A money market account is a type of deposit product offered by banks and credit unions that pays higher interests and has more flexible features than saving accounts.

Summary Of Money Market Accounts (MMA)

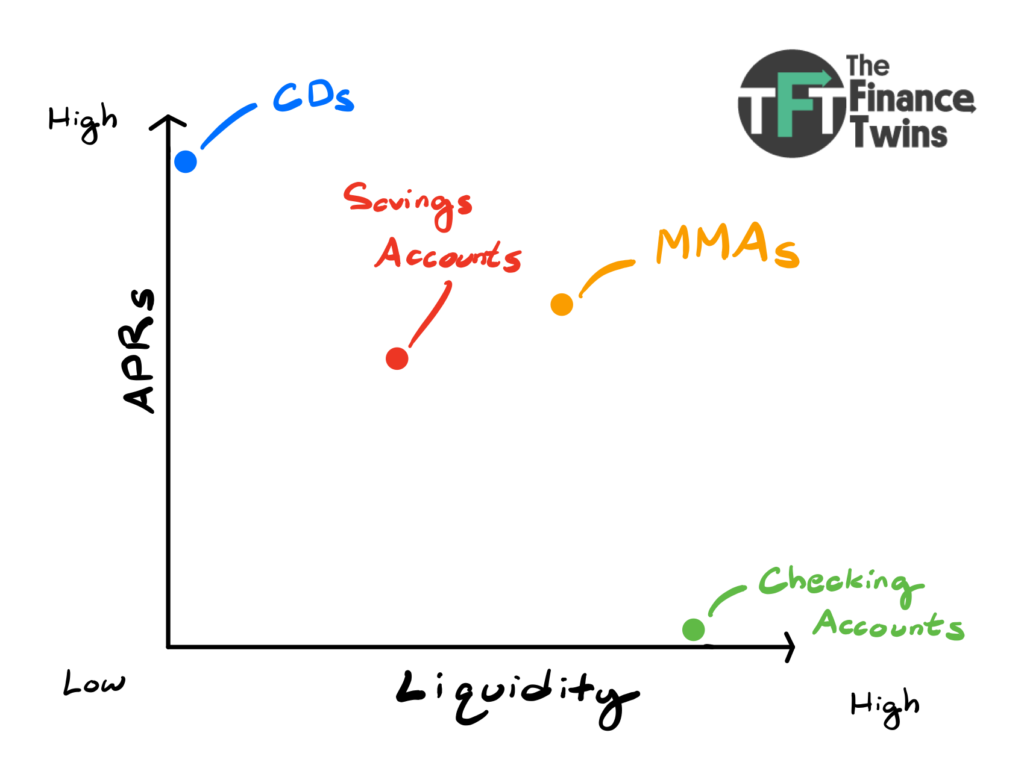

Money market accounts typically offer higher annual percentage yields (APY) than standard savings account. MMAs are like a cross between a checking and savings account, providing both high APYs and liquidity.

- Generally have excellent APYs

- Typically require high minimum balances

- Provide more access to funds via debit card and checks

- Limited to six (6) withdrawals a month

- Less liquid than checking accounts, but more than savings and CDs

We believe that MMAs shine when appropriately used alongside their friends, the certificate of deposit (CD), savings, and checking accounts. CIT Bank offers all these products.

How Do Money Market Accounts Work?

MMAs work similarly to saving accounts and certificates of deposit. You sign up for one (like CIT Bank’s) online or in person, provide some personal identification information, and sign the dotted line. Once completed, you deposit money and watch your savings grow.

Money market accounts are more flexible than standard savings accounts and CDs. You can generally access your money through checks or debit cards. Though, you can only withdraw your money a maximum of six times per month, limiting MMA liquidity.

Though, one norm is that MMAs generally require a high minimum deposit and balance. Banks may penalize you if your balance falls below the minimum.

Pros and Cons of Money Market Accounts

Although money market accounts have solid APYs and allow greater access to your money, they have some drawbacks. For example, maintaining an extensive minimum balance can be difficult. Even then, some high-yield savings accounts offer similar APYs at no minimum balance.

| Pros | Cons |

| High APYs | Limited to six (6) withdrawals a month |

| Has debit card and limited check use | Generally needs a minimum balance |

| FDIC insurance up to $250,000 | May have fees |

| More liquid than CDs and savings accounts | Less liquid than checking accounts |

When Should I Get A Money Market Account?

First, run through the eight steps of personal finance and establish some savings. Once you’ve built an emergency fund, you can start thinking about making the most of what you’ve saved up so far.

You should consider opening a money market account if you have enough money to meet minimum balance requirements and want to earn a higher interest rate. You should also read into high-yield savings accounts and certificates of deposits. Make sure you understand the differences between them—we talk more about them below!

With proper planning, you can make your money grow even more than before.

Say you have $10,000 in a standard savings account. If the economy is good and your life is stable, then you should consider opening an MMA. Why? MMAs usually have higher APYs than savings accounts!

There’s no perfect way to distribute your money, but it’s worth placing some cash into both your high-yield savings account and money market account to maximize the interest you earn. You can get even more technical and open an MMA, CD, and savings account.

Are Money Market Accounts Safe?

Yes!

MMAs are FDIC-insured up to $250,000, meaning that if the bank with you have the MMA with suddenly fails, the government will give you back your money. FDIC insurance applies separately to each FDIC-backed account you own.

With 2020 being the year of surprises and unpredictability, at least you can sleep well knowing your MMAs are protected.

Moreover, MMAs provide guaranteed returns. Comparably, investing in the stock market can be a risky, unpredictable task. MMAs list out the exact APYs you’ll get on your savings, making them a safe way to earn passive income.

How Are Money Market Accounts Taxed?

The interest you earn from MMAs is taxed according to your income tax bracket.

For example, if you earn $100 from a money market account in 2020, and your total taxable income for that year was $100,000, then you’d face a tax of 24% for your capital gains ($24).

The bank where you have an MMA will provide a 1099-INT statement when it’s tax season. The form contains precise information about the interest you earned.

Money Market Accounts vs. Different Types Of Accounts

There are a lot of different types of bank accounts. It can be overwhelming to try and figure out what they all do, and if you should even open them.

Read through the following, and you’ll walk out a little more confident!

There are primarily four different types of accounts:

- Checking

- Savings

- Certificates of deposits

- Money market

They differ in terms of liquidity, APYs, and minimum balances.

Money Market Accounts vs. Checking Accounts

Checking accounts are the most flexible account out there, granting you almost unlimited access to your funds. However, they earn little to no interest, creating a significant tradeoff.

MMAs earn much higher interest at the expense of less liquidity. There are also laws limiting the number of transfers and electronic payments you can do with your MMA to six (6). Individuals who surpass the limit will be fined, and their accounts may even be closed.

Thus, you shouldn’t put all of your money into an MMA nor a checking account. Instead, you should split between the two accordingly to maximize the interest you earn while being able to access your money for emergencies.

Money Market Accounts vs. Savings Accounts

Money market accounts and savings accounts are similar but have some minor differences. Generally speaking, MMAs have higher APYs than savings accounts.

According to the FDIC, the national average MMA APY on Jan 6, 2020, was 0.15% vs. savings 0.09%. Although these differences can seem minor, some high-yield savings accounts and MMAs can have rates that are 20x over the national average.

Though, it’s worth noting that MMAs typically require a higher minimum balance than savings accounts. Thus, it might be difficult to open an MMA vs. a no-minimum savings account like CIT Bank’s.

Furthermore, both are limited by a maximum of six (6) withdrawals per month. However, MMAs provide more ways to access your money via checks and debit cards that savings accounts don’t typically have.

Looking to learn more about the differences between them? Read our MMA vs. savings account article!

Money Market Accounts vs. Certificates of Deposits (CD)

CDs are the least flexible type of account, locking up your money for a set period. However, with this illiquidity comes great returns, since CDs generally have the highest APYs of all the accounts.

Given that MMAs are much more liquid, it’s good to mix your savings among the two to have as much access to your money as possible while maximizing your interest. Though, if you’re looking to get fancy, take a look into CD ladders!

MMAs vs. CDs vs. Savings Accounts vs. Checking Accounts

| MMAs | CDs | Savings | Checking | |

|---|---|---|---|---|

| APY | Higher | Highest | Lower | Lowest |

| Liquidity | Higher | Lowest | Lower | Highest |

| FDIC Insured | ✔ | ✔ | ✔ | ✔ |

| Checks | ✔ (limited) | ✔ (unlimited) | ||

| Debit card | ✔ | ✔ | ||

| Withdrawals per month | 6 | 0 | 6 | Unlimited |

| Minimum balance | ✔ | Sometimes | Sometimes | Sometimes |

| Annual fees | Sometimes | Sometimes | Sometimes | Sometimes |

What’s A Money Market Fund? Is It The Same As An MMA?

No, no, no! Don’t confuse the two.

A money market fund is a product offered by an investment company. It’s a mutual fund investing in safe assets such as U.S. Treasury securities. Money market funds are some of the least volatile investments out there, regarded to be pretty safe.

However, money market funds are not the same as money market accounts. For example, MMAs are protected by $250,000 worth of FDIC insurance, whereas money market funds have no such insurance protection.

Make sure you understand their differences!

How Do I Use Money Market Accounts With Other Accounts?

We’re glad you asked. Notice that these accounts all have differing levels of flexibility and APYs, with the least flexible (CDs) having the highest APYs, and vice versa.

Say you have $10,000, and you’re looking to maximize the interest you earn while maintaining some access to your money. You could split it in the following ways:

- $7,000 in a CD ladder

- $1,500 in an MMA

- $1,000 in a high-yield savings account

- $500 in your checking account

Why is this effective? Well, if you don’t need to have access to this money at a moment’s notice, you’ll get a better return on your money while maintaining some liquidity.

Consequently, stashing away 70% of your savings for the long term is a pretty solid move. You can even maintain flexibility by putting some money into a CD ladder.

With the remaining $3,000, I’d probably put a majority between an MMA and a high-yield savings account. Though, since MMAs require a high minimum balance, it may be challenging to find one that works if you only had $10,000 in the first place.

The basic idea behind all this distribution is that you’re trying to accrue the most interest possible while maintaining access to the money you need. The precise splits vary from person-to-person. Experiment and see what works best for you!

Is The Money Market Account The Best Bank Account To Have?

We don’t believe there’s necessarily a “best” type of account.

Although a checking account is an arguable necessity, MMAs genuinely do their best alongside their counterparts. Like in the previous example, opening all four types of accounts can keep your money liquid while maximizing your interest.

Essentially, each account has pros and cons that can cover one another. For instance, the high APYs of a CD cover the drawbacks of a checking account.

Frequently Asked Questions

Remember that CDs are illiquid, meaning that you have minimal access to your deposit. If you had an emergency and needed $500 on the spot, then getting funds from your CD will be an enormous hassle. Not to mention that you’d also have to pay early withdrawal fees.

It might be tempting to throw everything in to get as much interest as possible, but then you lose access to your money. Though, CD ladders fix this liquidity problem almost entirely.

The main difference between the two is that MMAs generally have higher APYs and higher minimum balances than savings accounts. MMAs also provide more ways to access your funds in a pinch.

For the most part, MMAs and savings accounts are pretty similar. If you’re just looking for something to place your savings in, either one works. Learn more about the differences in our MMA vs. savings account article!

John Ta is an undergrad at the University of Pennsylvania and the founder of Penn’s first undergrad personal finance club, Penn Common Cents. As a first-generation college student, he had to learn everything about personal finance on his own and seeks to mend the financial literacy knowledge gap seen almost everywhere. John is currently studying for an MS in Chemistry and a BA in Physics (business & tech concentration), Biochemistry, and Biophysics and is interested in the intersections of finance and healthcare.